Robinhood’s New Gold Card Raises BaaS Challenges, Alongside a Tiny Startup That Caught Stripe’s Attention

#Welcome to TechCrunch Fintech (formerly The Interchange)!

This week, we’re taking a closer look at some of the most exciting developments in the fintech space. From Robinhood’s new Gold Card to challenges in the BaaS space and how a tiny startup caught Stripe’s eye, there’s no shortage of fascinating stories to explore.

To stay up-to-date on the latest fintech news and analysis, subscribe to our newsletter here

##The Big Story

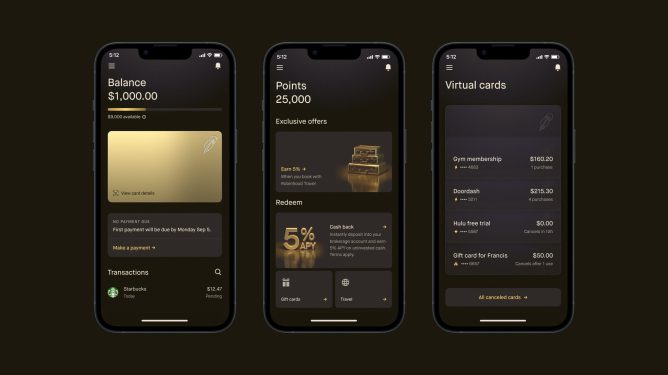

Robinhood took the wraps off its new Gold Card last week to much fanfare. This innovative credit card offers a range of impressive features, including 3% cash back and the ability to invest that cash back via the company’s brokerage account. Users can also put their cash back into Robinhood’s savings account, which boasts an attractive 5% APY.

We’re eager to see how this new card will impact Robinhood’s bottom line. But we’re equally fascinated by how the company incorporated the technology it acquired when buying startup X1 last summer for $95 million and turned it into a potentially very lucrative new offering.

##Analysis of the Week

The banking-as-a-service (BaaS) space is facing significant challenges. BaaS startup Synctera recently conducted a restructuring that affects about 15% of employees. This isn’t an isolated incident – other VC-backed BaaS companies, such as Treasury Prime, Synapse, and Figure, have also resorted to layoffs in the past year to preserve cash.

Meanwhile, according to American Banker, the FDIC announced consent orders against Sutton Bank and Piermont Bank, instructing them to keep a closer eye on their fintechs’ compliance with the Bank Secrecy Act and money laundering rules.

##Dollars and Cents

PayPal Ventures has made an investment in Qoala, an Indonesian startup that provides personal insurance products covering a range of risks, including accidents and phone screen damage. MassMutual Ventures also participated in Qoala’s latest funding round, which raised $47 million.

New Retirement, a Mill Valley-based company building software to help people create financial retirement plans, has raised $20 million in a tranche of funding. We last checked in on Zaver, a Swedish B2C buy-now-pay-later (BNPL) provider in Europe, when it raised a $5 million funding round in 2021. The company has now closed an extension to its Series A funding round, bringing the total to $20 million.

##Other Stories We’re Writing About

Read all about how a tiny four-person startup, Supaglue, caught Stripe’s eye. This innovative startup is using AI-powered tools to help companies optimize their operations and reduce costs.

We’re also exploring the growing trend of digital wallets in emerging markets. With more people turning to mobile payments, fintech startups are developing innovative solutions to meet this demand.

##Stay Up-to-Date with TechCrunch Fintech

Subscribe to our newsletter for the latest news and analysis on the fintech space. Our expert writers will keep you informed about the trends, innovations, and challenges shaping the industry.

No newsletters selected

- Subscribe for the industry’s biggest tech news: TechCrunch Daily News

- Get the latest news in AI: TechCrunch AI

- Stay up-to-date on the latest advances in aerospace: TechCrunch Space

- Startups are the core of TechCrunch, so get our best coverage delivered weekly: Startups Weekly

By submitting your email, you agree to our Terms and Privacy Notice.